Maryland Bankruptcy Lawyers

Bankruptcy is the process, governed by federal law, under which debtors seek protection from the collection efforts of their creditors. On the filing of a bankruptcy petition, an automatic stay goes into effect, preventing creditors from taking any further action to collect the debt. As a result, the filing of a bankruptcy petition can stop lawsuits, garnishments, and even foreclosures. In Maryland, an entity seeking bankruptcy protection files its petition for relief with the United States Bankruptcy Court for the District of Maryland. Although there are several different types of bankruptcy cases, most individuals seek relief under either Chapter 7 or Chapter 13. Experienced Maryland bankruptcy lawyers can help you successfully file a bankruptcy claim.

Although the federal government passed legislation in 2005 making it more difficult to file and maintain a successful bankruptcy case, most people are still eligible to obtain bankruptcy protection. Additionally, many people can still obtain the same type of relief as they could prior to October 17, 2005, which was the date the new laws became effective.

The introduction of means testing, the requirement of debtors to obtain different types of counseling, and the requirement of debtors to file tax returns are among the most significant of the major changes to the law that will affect consumers. The Maryland bankruptcy lawyers understand these laws and will help clients successfully file a bankruptcy claim.

What is Means Testing?

What is Means Testing?

This is the initial process used by the courts to determine the eligibility of persons to file for Chapter 7 bankruptcy protection. To be eligible to file under Chapter 7, a person’s household income must be below Maryland’s median income for that person’s household size. Because the state median income figures are computed by the federal government and change annually, the correct figure must be confirmed prior to filing a bankruptcy petition.

Can a Candidate for Bankruptcy Obtain Counseling?

Before a person may file for bankruptcy, he or she will need to obtain, or at least attempt to obtain, credit counseling from an approved nonprofit credit counselor. Additionally, once in bankruptcy, before someone can obtain a discharge, they will need to complete a financial management course from an approved counselor.

What is Chapter 7 Liquidation?

A Chapter 7 bankruptcy is often referred to as a liquidation. Chapter 7 bankruptcies are the most commonly filed bankruptcy cases. Under Chapter 7, the debtor is allowed to maintain a certain amount of property. The debtor must surrender all other non-exempt properties to the trustee, who will then sell the properties and divide the proceeds of the sale among the debtors and creditors. In many cases, debtors are not required to surrender any properties.

At the completion of the bankruptcy case, the debtor receives a discharge, relieving the debtor of any further legal responsibility for those debts included in the bankruptcy proceeding. However, the discharge does not eliminate the debt. Therefore, if someone else is responsible for the debt besides the debtor, the bankruptcy will have no effect upon their obligation to pay the debt.

What Should a Debtor Know About a Chapter 13 Repayment Plan?

Under Chapter 13, the debtor enters into a repayment plan that provides for the full or partial repayment of certain debts. Only debtors with regular income may receive protection under Chapter 13. The debtor must submit to the bankruptcy court a repayment plan providing for the repayment of a certain amount of the debtor’s debts. The debtor must obtain court approval for his or her Chapter 13 plan.

The debtor must also make monthly payments to the Chapter 13 trustee, who will then redistribute the payments among the participating creditors, according to the terms of the approved plan. Chapter 13 plans usually last between 36 and 60 months. Upon successful completion of the plan, the debtor receives a discharge, relieving any further legal responsibility for those debts included in the bankruptcy proceeding. Many debtors file Chapter 13 bankruptcy cases because they wish to prevent the loss of their car or home. Others are forced to file Chapter 13 simply because their average monthly income is too high, or the value of their property is too great.

A Maryland bankruptcy lawyer at LeViness, Tolzman & Hamilton will assist debtors in determining if they should file bankruptcy, and, if so, under what chapter they should file. We will draft each client’s bankruptcy petition, represent them during the meeting of creditors, and appear with them during hearings before the bankruptcy courts.

How Can a Debtor Stop Creditor Harassment?

The relentless pursuit by collection agencies only adds to the stress associated with overwhelming debt. Once someone files their bankruptcy petition, the heaps of letters and constant phone calls must end. Creditors and collection agencies are barred from contacting a debtor during bankruptcy proceedings and are prohibited from seeking payment on discharged debts when the bankruptcy is finalized. In addition, the bankruptcy stops foreclosure actions, meaning that debtors are permitted to remain in their home to negotiate an agreement on overdue amounts of a delinquent mortgage.

Does Automatic Stay Stop Creditor Harassment?

On filing the Chapter 13 petition, the court issues an automatic stay that prohibits creditors from contacting or attempting to collect debt in any way. The bank is barred from starting foreclosure proceedings or must cease further action if the client’s home is already subject to foreclosure. A Maryland foreclosure lawyer negotiates with financial institutions that are holding the client’s home mortgages and auto loans to reach reaffirmation agreements. We seek to alter the terms of the current loans so the client can repay delinquent amounts and retain possession of their home or motor vehicle.

What Properties are Exempt?

When someone files bankruptcy, they are able to keep some or all of their property by exempting it from the bankruptcy estate. Maryland law allows a debtor to protect approximately $12,000 of personal property of any type, such as household furnishings, clothing, bank accounts, and tax refunds; other types of property are also exempt. For example, a mechanic or other tradesperson may protect an additional $5,000 in tools. Life insurance proceeds, back child support payments, burial plots, and retirement benefits are also exempt.

Recently, Maryland began to allow individual homeowners to exempt just over $21,000 of the equity in their primary residence, making it easier for homeowners to file Chapter 7 bankruptcy. Our Maryland bankruptcy lawyers will assist clients in protecting as much of their hard-earned property as possible during bankruptcy.

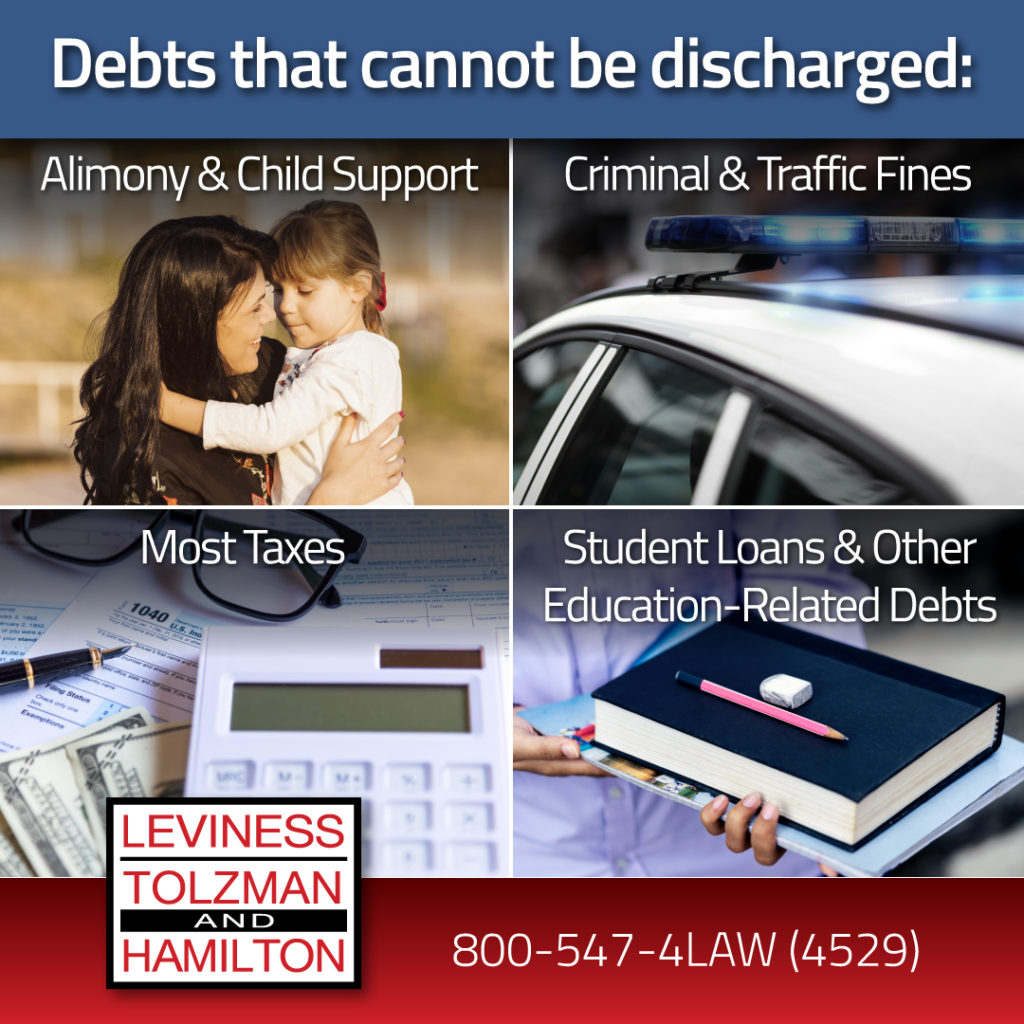

What is Non-Dischargeable Debt?

- Alimony and child support

- Criminal and traffic fines, including DUI penalties and traffic violation tickets

- Most taxes, including income tax debts that are less than three years old

- Student loans and other education-related debts

Creditors can also object to certain debts being discharged during the case depending on the circumstances surrounding the creation of those debts. For example, creditors can often object to the discharge of large debts incurred in the days and weeks just before the filing of the bankruptcy case. Creditors will also object to the discharge of debts created through fraud.

What is a Reaffirmation Agreement?

A reaffirmation agreement is a court-approved agreement between the debtor and creditor to remove a debt from a bankruptcy case. The debt will not be discharged, and the debtor will continue to pay the debt after the bankruptcy case is concluded. Debtors reaffirm debts secured by their house or car so that they can keep that property. However, a debtor may elect to reaffirm a debt to a credit union to preserve their membership in that credit union. A reaffirmation agreement must receive court approval, and the court will only approve an agreement that does not pose a hardship on the debtor.

How Can LeViness, Tolzman & Hamilton Help Debtors?

LeViness, Tolzman & Hamilton has been assisting clients through the bankruptcy process for many years. Our team meets with clients to discuss their financial situation and determines whether bankruptcy is right for them. Our lawyers will also advise clients as to which type of bankruptcy they can and should file. Although Chapter 7 is the most commonly filed type of bankruptcy, depending on the client’s particular financial situation, it may not be the best type of case to file. We assist clients in gathering all necessary paperwork to ensure that their petition is fully and accurately completed so they do not experience any unnecessary delays or problems with their application.

What are Chapter 13 Bankruptcy Repayment Plans?

A Chapter 13 bankruptcy plan runs up to five years. The plan cannot run longer than 60 months, but it can last for shorter periods of time. Under Chapter 13, a debtor submits a plan to the court detailing how much he or she will pay to creditors each month, and when certain creditors are to be paid. Once a legally acceptable plan is approved by the bankruptcy court, the debtor’s monthly payments to the Chapter 13 trustee will be distributed to the creditors. In most cases, after the successful completion of all plan payments, the remaining balances owed to the creditors will be excused or discharged. Monthly payments begin 30 days after the case is filed and continue until the case is concluded.

What Should Debtors Know About Priority Claims?

The payment of certain non-dischargeable debts takes priority over the payment of other debts during a Chapter 13 case. Domestic support obligations, such as alimony and child support payments, and recent tax debts, must be paid in full for the bankruptcy court to approve a Chapter 13 plan.

What is a Secured Debt?

Often, Chapter 13 cases are filed by those who wish to catch up on debts that are secured by a house and car so that they can save that property from foreclosure or repossession. Under Chapter 13, the debtor will continue to make payments according to the terms of their contract with the creditor while catching up on back payments owed to the creditor. However, sometimes a debtor may elect to entirely restructure their secured debt so that it is paid off through the plan.

Will the Debtor Have to Go to Court?

All bankruptcy cases involve a Meeting of Creditors, which is conducted by the trustee. This is essentially a question-and-answer session, and the debtor will be placed under oath. In most Chapter 7 cases, there is no court appearance before a judge. In Chapter 13 cases, there is a confirmation hearing, which is conducted before a judge, unless the terms of the Chapter 13 plan can be agreed to in advance. Various other motion hearings regularly occur; however, although the debtor must appear for the hearing, he or she is not usually required to testify.

When Will the Creditors Stop Calling?

Once a debtor has retained a Maryland bankruptcy lawyer, they may provide creditors with the lawyer’s contact information. When this occurs, most creditors contact the lawyer to verify if they represent the client. Legally, however, the creditors do not have to stop contacting the debtor until they have been notified that a bankruptcy case has been filed. Thus, some creditors may continue to call even after they are told that an attorney has been hired. All calls should stop within a week or two after the bankruptcy case is filed.

Will a Debtor Obtain Credit After They Filed for Bankruptcy?

It is probable that someone can obtain credit after filing for bankruptcy. The bankruptcy will be noted on one’s credit report; however, bankruptcy also eliminates debt and thus reduces the debt level. As a result, creditors are often willing to lend the debtor money. The general rule is that the larger the loan, the longer it will take someone to obtain the loan. For example, many individuals will have a credit card issued to them mere months after filing bankruptcy. Some clients may even obtain car loans immediately after they received their bankruptcy discharge. However, most individuals will usually wait a few years for their credit reputation to heal to qualify for a home loan or mortgage.

How Much Will It Cost to File Bankruptcy?

A Chapter 7 for a single person costs less than a Chapter 7 case for a couple. A Chapter 13 case is more complicated than a Chapter 7 case and thus more expensive. However, payment plans are offered by our office and, in fact, are often a component of Chapter 13 cases. Our office has a set schedule it charges for these cases, and an explanation of fees will be provided during an initial consultation.

No one is required to hire us during the initial consultation; we will advise the debtor which type of bankruptcy we recommend, what it will generally cost to file, and send the debtor a retainer agreement in the mail so that they can consider at home if this is right for them.

Will Everyone Know That a Debtor Filed Bankruptcy?

Although the average person can find out who filed bankruptcy, he or she would have to contact the correct court and specifically request information about that person. Although employers will often learn of a Chapter 13 filing, only the person’s creditors are initially told of the case. Usually their friends, family, and neighbors will learn of the filing only if the debtor tells them.

What is a Discharge?

A discharge is the declaration by the federal government that the person does not owe the debts that they owed on the date they filed the bankruptcy case. Remember, certain debts are not dischargeable. Most student loans, recent state and federal taxes, alimony and child support, fines, criminal restitution orders, and certain personal injury judgments survive bankruptcy. Additionally, nothing can prevent someone from paying a discharged debt. The discharge simply prevents creditors from collecting the debt from the person.

Will a Debtor Lose Everything They Own?

Almost all individuals who file bankruptcy retain their property. The law allows for individuals to keep up to a certain value or amount of property free of the bankruptcy filing. If someone has valuable property, they may need to file a Chapter 13 to keep all of their property, but for the average person or family, this is often not an issue.

Can Someone File Bankruptcy More Than Once?

Unfortunately, bad things can happen to good people more than one time in their lives. There are certain requirements, but someone will be able to file again once eight years have passed since the previous case was filed. Depending on the person’s situation, they may be able to receive relief.

Is There an Amount of Debt Required to File Bankruptcy?

Someone may have too little debt for it to make financial sense to file, but this depends on their particular financial situation. If someone is having difficulties meeting their obligations, they should contact our office to see if bankruptcy makes sense for them. However, it is possible to have too much debt to file for Chapter 13. Any amount over $300,000 worth of unsecured debt, which does not include a mortgage or car loan, exceeds the bankruptcy threshold.

How We Can Help

Since our firm was founded in Baltimore, bankruptcy laws have undergone many significant changes, most notably in 2005 when legislation introduced means testing, credit counseling, and tax return requirements. Our attorneys remain up to date on the bankruptcy statutes and how the current economic environment and judicial interpretations affects clients’ rights and options.

Maryland Bankruptcy Lawyers at LeViness, Tolzman & Hamilton Help Clients Struggling with Bankruptcy

Our Bankruptcy Attorneys in Maryland are committed to providing personalized and prompt service. We have the experience and expertise necessary to obtain the results you deserve. Call us today at 800-547-4LAW (4529) or contact us online for a free consultation.

With offices in Baltimore, Columbia, Glen Burnie, and Prince George’s County, we represent clients throughout Maryland, including those in Anne Arundel County, Baltimore County, Carroll County, Harford County, Howard County, Montgomery County, Maryland’s Western Counties, Prince George’s County, Queen Anne’s County, Southern Maryland, and the Eastern Shore, as well as the communities of Catonsville, Essex, Halethorpe, Middle River, Rosedale, Gwynn Oak, Brooklandville, Dundalk, Pikesville, Nottingham, Windsor Mill, Lutherville, Timonium, Sparrows Point, Ridgewood, and Elkridge.

Frequently Asked Questions

What is Means Testing?

What is Means Testing?